Abbott's Frozen Custard

Abbott's Frozen Custard®

Business Model Overview

Abbott’s Frozen Custard is a retail frozen custard franchise offering frozen custard, soft drinks and related desserts and food products. The business model centers on retail sales to the public through in-person channels — including carry-out, optional indoor seating (dine-in), and drive-throughs (which the franchisor strongly encourages) — and the franchisor also authorizes short-term satellite kiosks intended for carry-out or delivery. Franchisees operate primarily stand-alone Abbott’s retail stands (with various configurations) and may develop satellite kiosks in close proximity to an existing full-service stand.

Pros & Cons Analysis

Pros

Cons

Legal Risk Score

Franchisor sued a franchisee for long‑running defaults — false records, unapproved POS, products and suppliers — seeking injunction, termination, and damages; parties agreed to a standstill and are pursuing a transfer. Score indicates moderate legal risk: franchisor enforces standards vigorously, so prospective owners should expect strict compliance and do close due diligence.

Territory Protection Score

The franchisee receives no meaningful territorial protection — the 'none' designation means no exclusive or protected area is granted. While the franchisor does not appear to reserve online sales or the explicit right to reduce the territory, the franchisee also lacks a right of first refusal, leaving protection minimal and resulting in a very weak score (0/100).

Training & Support Score

With a very low training_and_support_score (0), Abbott's Frozen Custard offers a limited training program: it provides no on-site training — a major weakness — and only a limited number of formal hours (0 hours reported). No initial personnel are included in the fee, and living expenses are not covered, leaving franchisees with minimal direct support during launch and operations.

Executive Summary

Initial outlay includes an expensive non‑refundable $37,000 franchise fee plus substantial buildout and equipment costs (operational equipment ~$256–273k and real estate/improvements ranging from ~$114k to $1.3M), meaning total startup capital can reach the mid‑six to seven figures when inventory and 3–6 months reserves are included. Item 19 (audited) shows franchised stands averaged $369,996 gross sales (median $333,735, n=5) with high variability and only 40% meeting the average; drive‑through-configured locations produced materially higher sales (median ≈$683k), signalling that site configuration is a primary revenue driver. Key risk factors: no territorial protection (score 0), essentially no on‑site initial training or launch support (training score 0), a moderate legal‑risk profile with pending enforcement action, and mandatory personal/spousal guarantees. In sum, the opportunity offers meaningful upside in optimal drive‑through sites but is a high‑variability, high‑capex, and enforcement‑intensive proposition with limited franchisor cushioning.

Performance Analysis

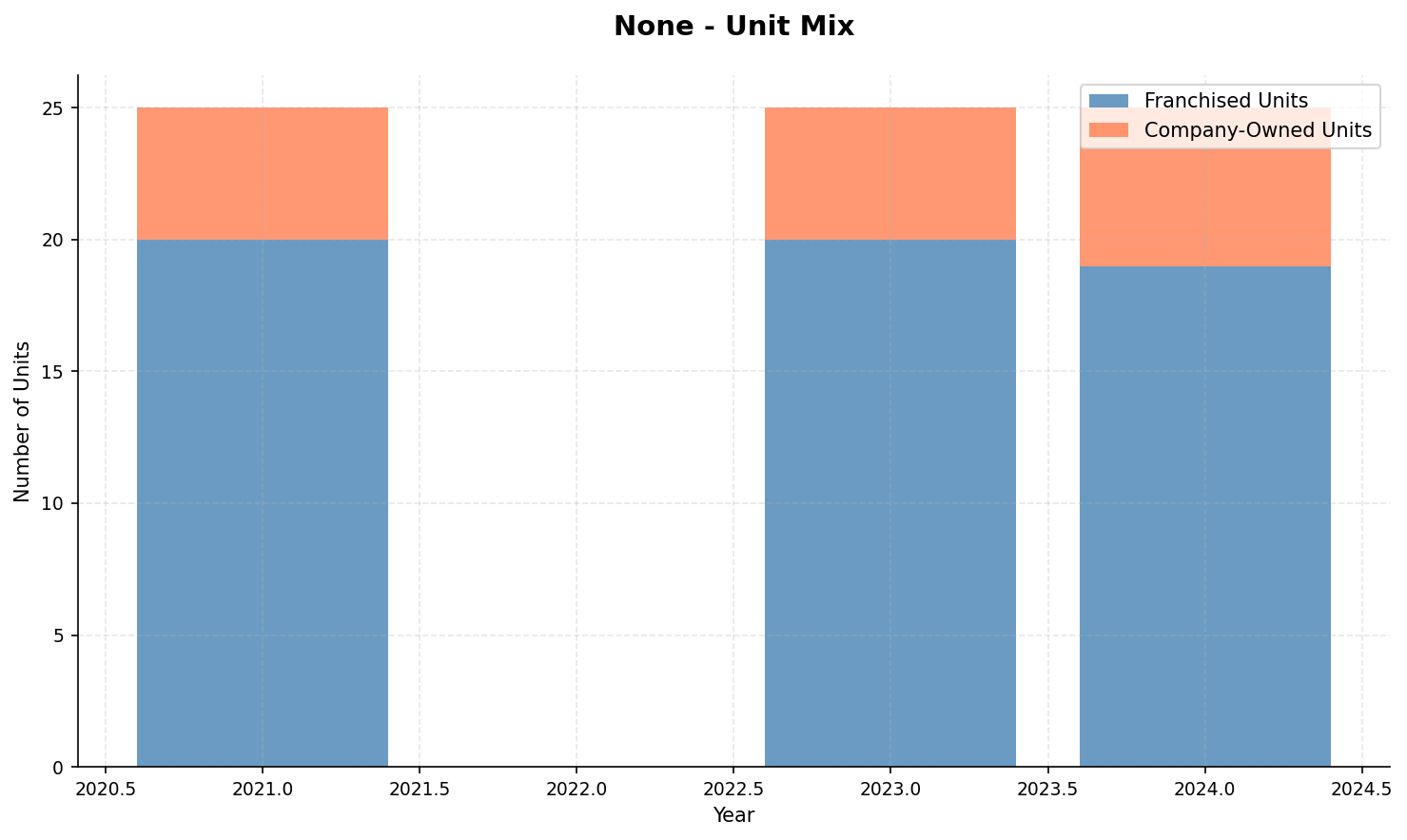

The total_units_growth chart documents the franchise’s unit-count trajectory from 2021 through 2024, and the unit_mix chart shows how those units are distributed across formats over the same period. Prospective franchisees should use these charts together to determine whether expansion has been broad-based or concentrated in specific formats—rising total_units_growth paired with a shift in unit_mix toward smaller, lower-capex units suggests a scalable growth strategy, whereas stagnant total growth with concentration in flagship formats may indicate market saturation and higher upfront investment requirements.

Key Performance Indicators

None total units growth from 2021 to 2024

None unit mix from 2021 to 2024

Financial Performance Analysis (Item 19)

Investment Requirements

Interested in Abbott's Frozen Custard?

Get more information and connect with the franchise directly.