FYZICAL

FYZICAL®

Business Model Overview

FYZICAL is a franchise in the Health & Wellness category that grants Unit Franchises for FYZICAL® Centers providing physical therapy, medically-based physical wellness, balance retraining, sports rehabilitation and related wellness services. Under this Area Representative program, an Area Representative is granted the rights to solicit and promote the sale of Unit Franchises within a designated territory and to render specified support services to Unit Franchisees. The core service bundle for Area Representatives is franchise sales and support activities, including assistance with site selection and supervisory guidance during grand openings and initial operations, with compensation tied to commissions on initial franchise fees and a share of royalties.

Pros & Cons Analysis

Pros

Cons

Legal Risk Score

FYZICAL faces multiple ongoing suits: a franchisee (PG Therapy) alleges breach, fraud and seeks over $357,000; two former employees allege whistleblower retaliation; and a qui tam False Claims Act case involves PPP loan certifications. These pending claims suggest moderate franchisee risk to reputation, operations and potential costs—warranting careful due diligence.

Territory Protection Score

The franchisee receives a 'protected' but not exclusive territory, a common but less safe arrangement; however, the franchisor can reduce the territory for non‑performance and may sell online within the area, while the franchisee lacks a right of first refusal. These constraints, reflected in the 19/100 score, indicate weak territorial protection.

Training & Support Score

With a low training-and-support score (17.0), FYZICAL offers a limited training program: only 34 total training hours and the initial fee covers zero people. Critically, on-site training is not provided — a major weakness — and the franchisor does not cover living expenses, leaving minimal hands-on support.

Executive Summary

FYZICAL’s Area Representative offer grants rights to sell and support unit franchises in a defined protected territory but carries an expensive upfront area-rep fee estimated at $300,000–$1,000,000 plus modest additional startup costs. Territory protection is weak (19/100): the franchisor can sell online in the area, shrink territories for non‑performance, and there is no right of first refusal—a high‑risk indicator for territorial value. Training and support are limited (17/100)—only 34 hours, no on‑site pre/post opening training, and mandatory ongoing training costs $1,500 (paid by the franchisee)—suggesting minimal hands‑on operational help. Performance visibility is poor (no Item 19/audited financials) and legal risk is elevated by four pending suits, including fraud and a qui tam matter, leaving revenue and litigation exposure uncertain despite a modest system size (58 franchised units).

Performance Analysis

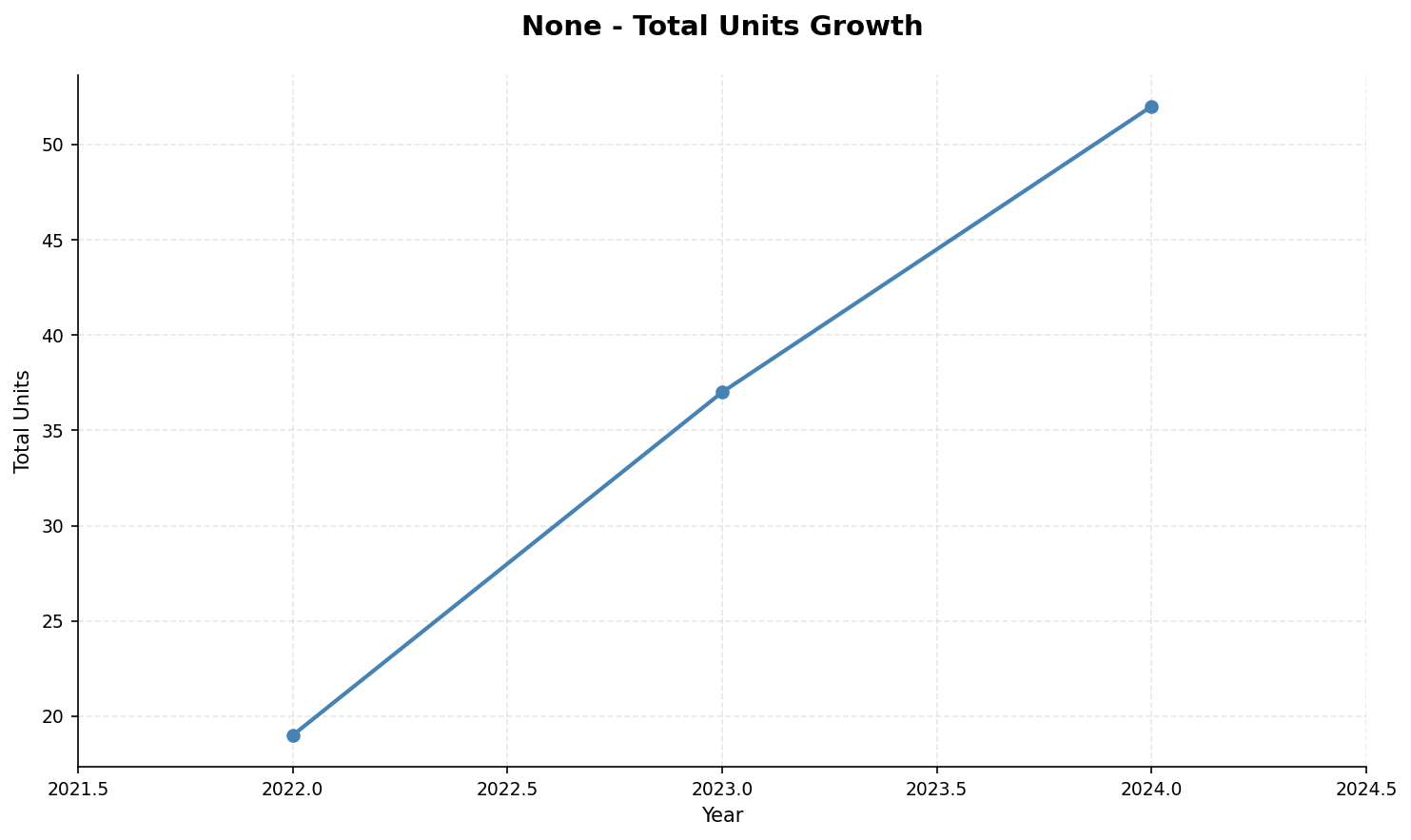

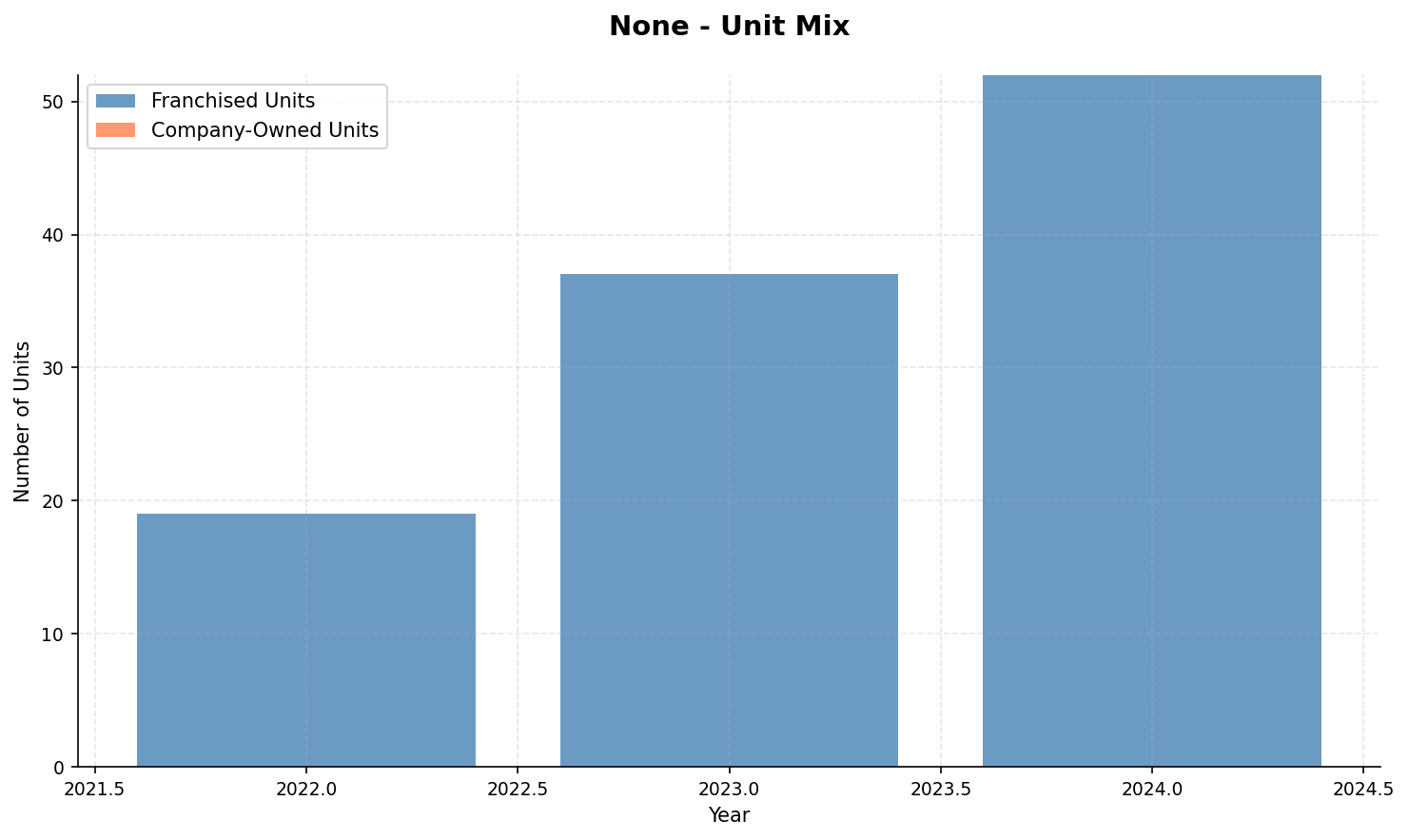

The total_units_growth chart (total_units_growth) documents the franchise’s unit count from 2022 through 2024 and should be used to assess whether overall system growth accelerated, stalled, or contracted over that period. The unit_mix chart (unit_mix) shows the distribution of unit types across 2022–2024, and together these charts indicate whether growth was broad‑based or concentrated in specific formats—information prospective franchisees should use to judge likely unit economics, required support resources, and the business’s future scalability.

Key Performance Indicators

None total units growth from 2022 to 2024

None unit mix from 2022 to 2024

Financial Performance Analysis (Item 19)

This franchise company did not publish these results.

Investment Requirements

Risk Analysis

- legal_risk_score: 49.706135122767684 vs 100.0 industry avg

Interested in FYZICAL?

Get more information and connect with the franchise directly.